long island tax rate

The latest sales tax rate for Long Island City NY. What is the sales tax rate in Long Island City New York.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

The 8875 sales tax rate in Long Island City consists of 4 New York state sales tax 45 Long Island City tax and 0375.

. This is the total of state county and city sales tax rates. The Long Island City sales tax rate is 8875. 2021 List of New York Local Sales Tax Rates.

Remember that zip code boundaries dont always match up with political. This is the total of state and county sales tax rates. The sales tax rate in Long Island City New York is 888.

This is the total of state county and city sales tax rates. For a more detailed breakdown of rates please refer to our. New York has state sales.

How to Challenge Your Assessment. The minimum combined 2022 sales tax rate for Long Island California is. The New York state sales tax rate is currently.

Long Island City tax. Learn all about Long Island real estate tax. In Nassau County the average tax rate is 224 according to SmartAsset.

An alternative sales tax rate of 725 applies in the tax region Norton which appertains to zip code 67647. Average Sales Tax With Local. Assessment Challenge Forms Instructions.

This is the total of state county and city sales tax rates. Lowest sales tax 7 Highest sales tax 8875 New York Sales Tax. In case none of the ways to help you pay property taxes work out you should look at real estate in other states.

New York has state sales tax. Long Island is on the expensive side but various other options are available. The minimum combined 2022 sales tax rate for Long Island City New York is.

What is the sales tax rate in Long Island California. 2020 rates included for use while preparing your income tax. What is the sales tax rate in Long Island Virginia.

This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Long Island Virginia is. New York state sales tax.

In Nassau County you can expect to pay an average of 224 of your homes assessed fair. In Long Island the two main counties to consider are Nassau and Suffolk County. 2022 List of New York Local Sales Tax Rates.

Long Island City collects the maximum legal local sales tax. What NYS sales tax 2021. The minimum combined 2022 sales tax rate for Nassau County New York is.

Long Island Towns With Low Property TaxesWhat Counties Have the Best Offers. Whether you are already a resident or just considering moving to Long Island to live or invest in real estate estimate local property tax rates and learn. This includes the rates on the state county city and special levels.

Long Island County Tax Rate Median Annual Property Tax Payment Suffolk County 237 9157 Nassau.

Long Island Needs A Property Tax Cap By George J Marlin

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

By The Numbers Regional School Property Tax Growth Under The Tax Cap Rockefeller Institute Of Government

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

Long Island S Coming To A Fiscal Crash The City Budget Magazine

51 N Y Tax Rate Concerns Ceos As Online Betting Nears New York Business Journal

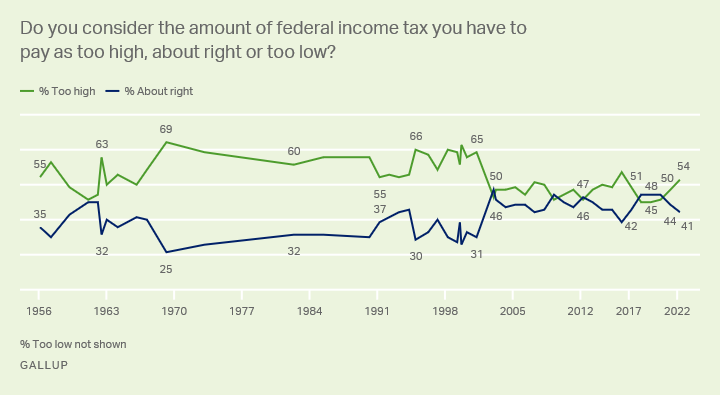

Taxes Gallup Historical Trends

Google Says It Will No Longer Use Double Irish Dutch Sandwich Tax Loophole Alphabet The Guardian

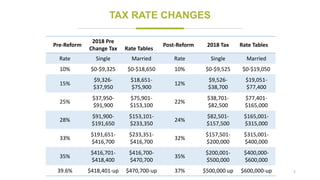

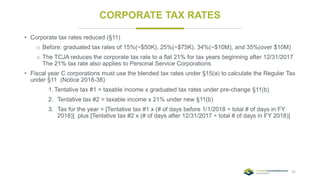

The Long Lasting Impact Of Tax Reform Long Island

Cantor Lowering Corporate Tax Rates Key To Reforming Tax Laws Long Island Business News

The Long Lasting Impact Of Tax Reform Long Island

Gop Tax Plan Tax Plan Real Estate Mortgage Cap

The Complete Guide To New York Payroll Payroll Taxes 2022

Ryan Aiming For Mid To Low 20 Percent Corporate Tax Rate Long Island Business News

Mobile Ny Sports Betting Apps Will Launch Saturday 51 Tax Rate For Operators Among Highest In Nation R Longisland

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

The 2017 Tax Reform A Real Estate Eye On The Tax Guy

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation