colorado electric vehicle tax credit form

Credits on Form 1040 1040-SR or 1040-NR line 19 and Schedule 3 Form. Colorado Electric Vehicle Tax Credit.

Claiming The 7 500 Electric Vehicle Tax Credit A Step By Step Guide

This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form.

. October 28 2022 300 pm 500 pm 2855 63rd St 2855 63rd Street Boulder CO 80301 Front Page Fun Ride Drive. Information about Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file. DR 0350 - First-Time Home Buyer Savings Account Interest Deduction.

Hybrid electric vehicles and trucks Manufactured and converted electric and plug-in hybrid electric motor vehicles and trucks that are propelled to a significant extent by an electric. If you lease an electric vehicle for two years beginning before the end of 2020 you can get a 2500. Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase.

DR 0347 - Child Care Expenses Tax Credit. Save time and file online. Via the Hop Electric Fleet Brewery Event.

You do not need to login to Revenue Online to File. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. Light duty electric trucks have a gross.

November 17 2020 by electricridecolorado. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. Extension of Time for Filing Individual Income Tax Payment Form.

Extension of Time for Filling C. Some dealers offer this at point of sale. More about the Colorado Form DR 0617 Corporate Income Tax Tax Credit TY 2021.

Colorado Tax Credits Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. You may use the Departments free e-file service Revenue Online to file your state income tax. Form 8936 is used to.

Both the state and the federal government have tax credits that you can take advantage of when purchasing an electric vehicle. Sales Tax Return for Unpaid Tax from the Sale of a Business. DR 0346 - Hunger Relief Food Contribution Credit.

Plug-In Electric Vehicle PEV Tax Credit. DR 0366 - Rural Frontier. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

2500 credit received with state income tax refund for full battery electric vehicle BEV may be applied at purchase with many electric vehicle. If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Colorado Tax Credits. The table below outlines the tax credits for qualifying vehicles. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Contact the Colorado Department of Revenue at 3032387378.

Electric Vehicle Incentives What You Need To Know

Electric Car Tax Credits Ne Electric Vehicle Incentives

Buy An Ev Before The End Of The Year And Get 13 500 In Tax Credits Drive Electric Northern Colorado

Biden Bill Includes Boost For Union Made Electric Vehicles Pbs Newshour

What Is An Ev Tax Credit Who Qualifies And What S Next

Tax Credits Drive Electric Northern Colorado

Dealerships And The Electric Vehicle Tax Credit Wipfli

Zero Emission Vehicle Tax Credits Colorado Energy Office

A Complete Guide To The Electric Vehicle Tax Credit

How To Claim An Electric Vehicle Tax Credit Enel X

How To Get The Federal Ev Charger Tax Credit Forbes Advisor

Gm Vehicles Eligible For Ev Tax Credit On January 1st 2023

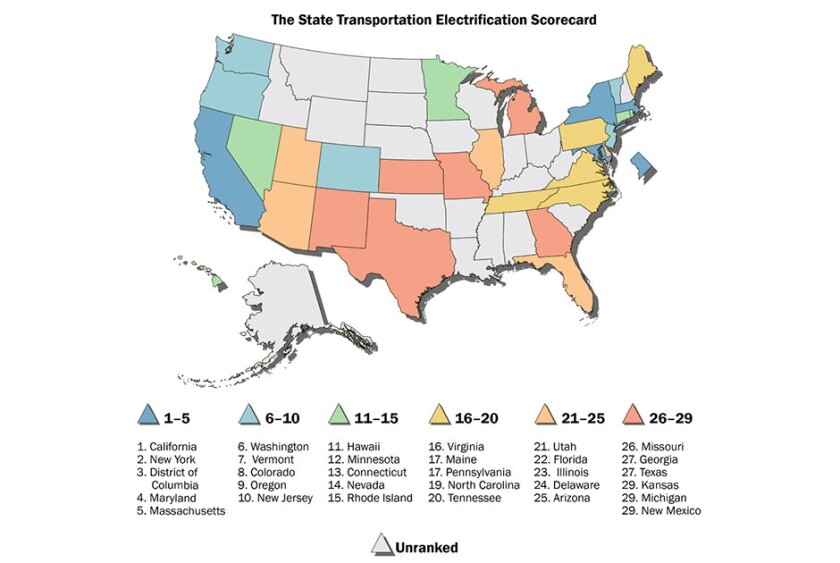

States Show Limited Progress With Electric Vehicle Policies

Ev Charging Rebates Incentives Semaconnect

Tax Credit For Electric Vehicle Chargers Enel X Way

How To Claim Your Federal Tax Credit For Home Charging Chargepoint